Reactivation & Win-Back Engine: Mine Old Leads with Consent

Reactivation & Win-Back Engine

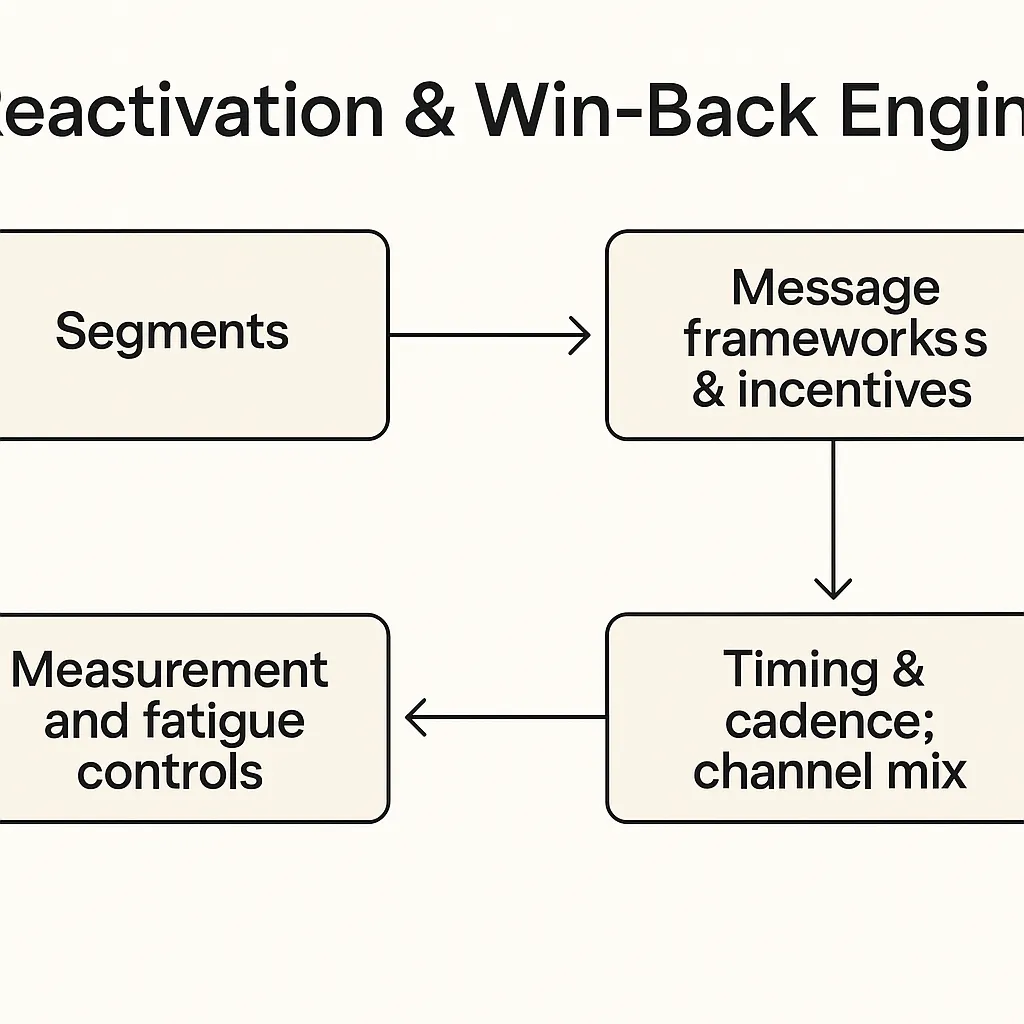

If you’re not mining your dormant leads and past customers, you’re paying CAC twice. A reactivation & win-back engine turns forgotten pipeline into near-term revenue—without torching deliverability or violating consent. The playbook below shows how to segment truthfully, craft messages with context, time touches across channels, and add measurement and fatigue controls that protect your brand.

Quick compliance note (US): commercial email must follow CAN-SPAM (clear identification, unsubscribe, physical address, honoring opt-outs), and SMS/MMS marketing requires prior express written consent and honoring revocations—including the 10-business-day rule for robocalls/robotexts set by the FCC in 2024–2025. Always document consent and opt-outs.

Segments (stalled, no-show, closed-lost, churned)

A strong engine starts with precise, mutually exclusive segments. Build from CRM/system-of-record fields, not marketing lists. Minimum fields you should persist for each record: status_at_last_touch, last_touch_channel, consent_type, consent_timestamp, source, proof_uri, and do_not_contact_scope.

Four core segments

Stalled — Engaged previously but inactive for N days (e.g., MQL/SAL/SQL that went cold).

Signal: last activity >45–90 days; meetings canceled or ignored.

Offer angle: revive the original promise with a product update or new outcome story.No-show — Booked but didn’t attend.

Signal: calendar object existed; zero attendance.

Offer angle: friction-free reschedule + condensed “5-min outcomes demo” or ROI calculator.Closed-lost — Evaluated and chose an alternative.

Signal: competitive loss reason; price/feature mismatch.

Offer angle: targeted feature gap closure, connector launched, or total cost model change.Churned — Former customer who canceled or didn’t renew.

Signal: churn date >30 days; product usage = 0.

Offer angle: “Second-life value” plan, migration concierge, or bundled seats.

Benchmarks—expectations to set with Sales/CS

Reactivation outcomes vary by segment and industry. For B2B email-led re-engagement, teams often target low-single-digit conversion back to pipeline (≈3–5%) and treat double-digits as exceptional; ecommerce win-back studies show materially higher rates (≈20–30% to repurchase) because the ask is lighter. Calibrate goals by segment and offer richness. HubSpot Community+1

Data hygiene

Deduplicate by email + phone + company domain.

Respect suppression lists across channels.

Map consent and revocations at the identity level, not just contact records.

Add “relationship notes” (e.g., prior discount, support escalations) to avoid tone-deaf outreach.

Action: tag your database into the four segments above, add consent provenance fields, and set baseline goals per segment before you Launch the Win-Back Sequence.

Message frameworks & incentives

Every message must acknowledge the history. You’re not “cold”; you’re reconnecting with someone who already has context—good or bad.

Frameworks (drop the fluff, show outcomes)

Stalled: “Since we last spoke, teams like you shipped X faster using Y. Here’s a 90-second walkthrough of the new [feature/outcome].”

No-show: “We saved you a seat—5-minute outcomes demo or a 20-minute working session. Pick what fits.”

Closed-lost: “You chose Z for [reason]. Since then, we released [feature] and now integrate with [critical tool]. Here’s how that changes TCO.”

Churned: “Many former customers return when [trigger: hire, new system, cost pressure]. We’ll migrate you in one hour and credit [unused/pro-rated] fees.”

Incentive menu (use sparingly, tie to economics)

Time-boxed price protection (honor prior quote for 30 days).

Migration concierge (done-for-you import, zero-touch cutover).

Risk reversal (month-to-month restart, no annual lock until value proven).

Usage credits (metered products) instead of % discounts.

Bundle adds (partner add-ons, training seats) vs headline price cuts.

Compliance & re-permissioning cues

Email: clear identity, a working one-click unsubscribe, and honoring opt-outs. (See the FTC’s CAN-SPAM guide.) Federal Trade Commission

SMS/MMS: don’t send marketing texts without prior express written consent; provide straightforward opt-out keywords (STOP/UNSUBSCRIBE) and honor revocations within 10 business days under the FCC’s 2024 Report & Order. CTIA’s best-practice guide sets carrier-accepted norms for consent and messaging. Federal Register+1

Action: draft one short, context-aware message per segment and choose one incentive that fits your CAC/LTV model; add the CAN-SPAM footer and STOP language, then Launch the Win-Back Sequence.

Timing & cadence; channel mix

Don’t sprint; pace. You’re trying to surface timing triggers, not carpet-bomb the inbox.

Cadence by segment (baseline)

Stalled: 3 touches over 14 days (email → LinkedIn DM → email), then pause 30 days.

No-show: 2 touches in 72 hours (SMS reminder if consented → email with 2 calendar links), then one follow-up at day 7.

Closed-lost: 3-touch micro-sequence over 21 days tied to a specific change (feature release, pricing model, integration).

Churned: quarterly “second-life value” check-ins, plus immediate trigger sequences when you ship something that closes their original gap.

Channels (with compliance guardrails)

Email for detail and assets; ensure clear footer and functioning unsubscribe (FTC). Federal Trade Commission

SMS/MMS only with documented consent; include standard keywords and honor opt-outs within 10 business days (FCC 2024 order; revocation “reasonable manner” standard). Carriers follow CTIA principles, so align copy and flows accordingly. Federal Register+1

LinkedIn for light touches; avoid automation patterns that flag as spam.

Phone for high-value accounts; script opt-out capture and disposition codes.

Time since last engagement matters

Fresh losses respond best. In many programs, you’ll see higher reactivation in the first 30–90 days post-churn/closed-lost, then diminishing returns. Treat aging cohorts differently: shorter sequences, gentler offers, and a “park” state until a real trigger emerges. Ecommerce studies often publish higher “win-back” rates; B2B asks (vendor switch, budget change) are heavier—use that to set stakeholder expectations. winbacklabs.com

Action: load your CRM with four pre-built sequences by segment, schedule touches over 2–3 weeks, and gate SMS to contacts with explicit consent before you Launch the Win-Back Sequence.

Measurement and fatigue controls

You’re not done until the loop closes—and the loop includes suppression.

Core metrics (define up front)

Reactivation rate (per segment): returned to qualified pipeline (stalled/no-show/closed-lost) or re-subscribed/paid (churned).

Second-life value (SLV): LTV of reactivated customers vs net-new LTV.

Time-to-win-back: days from first touch to reactivation.

Opt-out & complaint rate: per channel, per message.

Inbox/SMS health: bounce rates, carrier filtering, blocklist checks.

Payback: (incremental gross profit from reactivations – program cost) ÷ program cost.

Guardrails that protect your brand

Global fatigue caps: e.g., no more than 2 reactivation touches/week/person across all segments; no SMS without consent; no contacting anyone with non-marketing DNC in the last 10 business days after revocation per FCC. Federal Register

Suppression logic: if a contact negatively replies (“stop,” “unsubscribe,” “not interested”), auto-suppress channel + add a note.

Re-permissioning flows: for old lists with uncertain consent, run a one-off re-permission email that (1) states value, (2) asks them to confirm preferences, (3) makes opt-down easy, and (4) removes non-responders after a defined window. (Aligns with best-practice guidance for consented outreach.) Federal Trade Commission+1

Benchmarks to sanity-check performance

B2B email-led reactivation to pipeline (stalled/closed-lost): 3–5% is common; >7% indicates strong product news or timing. Community data points show teams using this as a “good” outcome band. HubSpot Community

Churned-to-paid reactivations: Target low-double-digit rates for recent churn cohorts; ecommerce win-back studies cite ~26% average repurchase—directionally higher than B2B motions. Use this to set expectations with Finance. winbacklabs.com

Ops instrumentation

Attribution: tag all assets/links with UTMs; pipe to CRM and BI.

QA gates: preflight checks for consent flags, DNC status, and channel eligibility; simulate STOP/UNSUBSCRIBE and confirm suppression.

Reviews: weekly by segment: volume, outcomes, opt-outs, and any deliverability flags.

Action: publish a dashboard with reactivation rate, SLV, opt-outs, and time-to-win-back; enforce fatigue caps and re-permissioning rules before you Launch the Win-Back Sequence.

Sources used — Federal Register (2024); FTC (2023); CTIA (2023); Winback Labs (2023)